STRATEGICCAPITALPARTNER

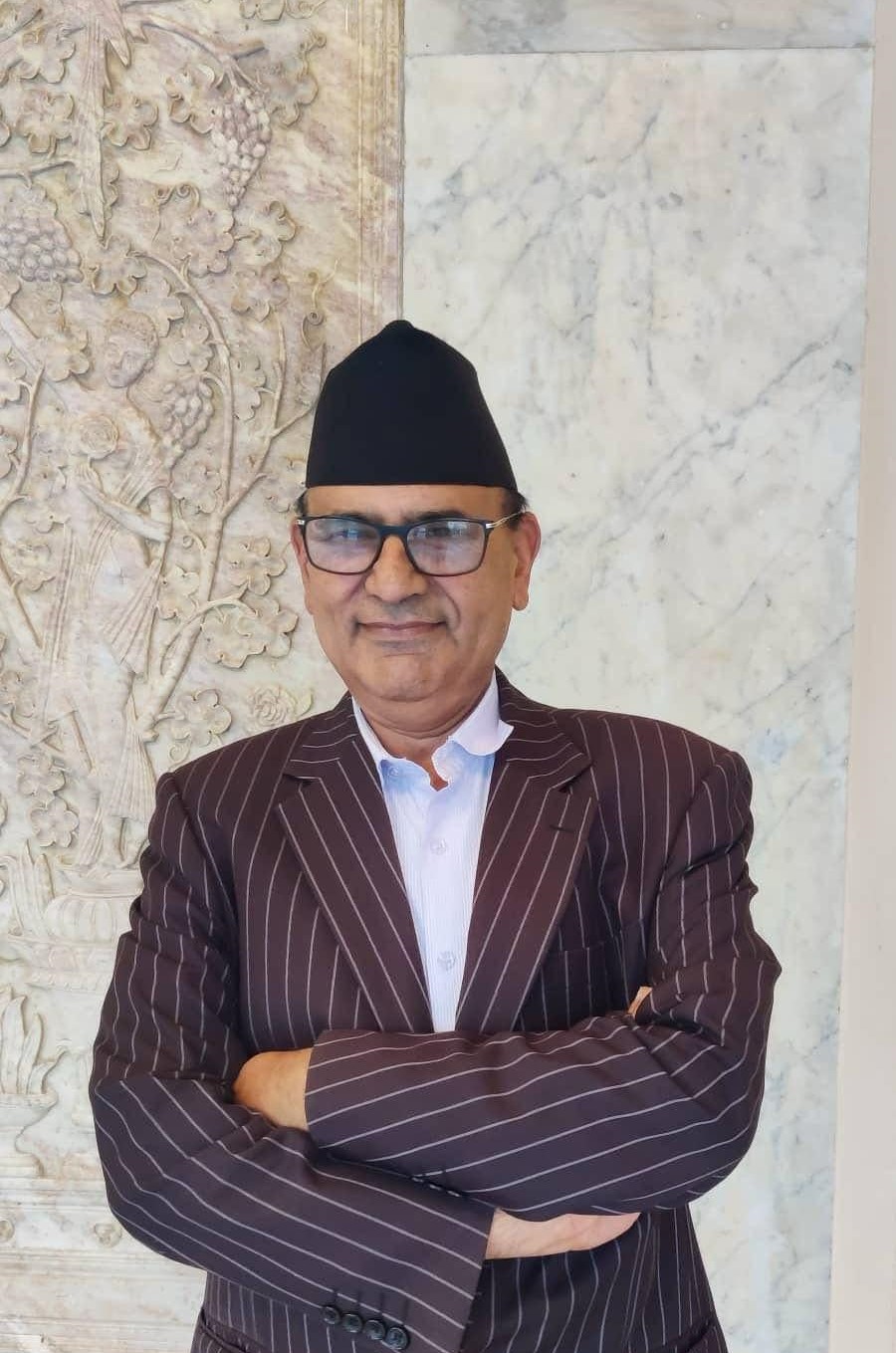

Rajeev poudel is a seasoned venture capitalist and strategic partner with deep roots in technology and quantitative finance. He specializes in scaling high-impact startups across the global landscape.

Asset Growth

+42% YoY

ABOUT RAJEEV

Managing Partner with over 15 years of experience in global asset management and venture development.

Rajeev focuses on identifying and nurturing founders who are solving systemic global challenges. His expertise spans across Fintech, AI, and green energy, where he provides both capital and strategic operational guidance.

- Global Network — Extensive connections across Silicon Valley, London, and the emerging tech hubs of Asia.

- Operational Excellence — Deep expertise in scaling unit economics and optimizing go-to-market strategies.

Years of Expertise

Pioneering investments in disruptive technology.

Strategic Portfolio

Managed assets across 40+ high-growth firms.

Exits Above 10x

Delivering exceptional value to partners.

INVESTMENT

PHILOSOPHY

We believe in long-term partnerships, sustainable growth over hype, and the transformative power of technology.

2024 • STRATEGY

Quantitative Analysis

Every decision is backed by rigorous data analysis and market stress-testing to ensure resilience.

CORE • PRINCIPLE

Visionary Partnership

We back people, not just ideas. We provide the operational scaffolding so founders can build.

ESG • FOCUS

Impact Investing

Generating alpha while solving the world's most pressing climate and social challenges.

PARTNERSHIPS BUILT ON TRUST

"Rajeev's insight into global market cycles was pivotal for our expansion."

Himal Bhattrai

Strategic Partner

"A partner who understands the technical depth as much as the economics."

Koshraj Subedi

Strategic Partner

"Unmatched strategic support in the early stages of product development."

Krishna Neupane

Strategic Partner

ACADEMIC &

PROFESSIONAL QUALIFICATIONS

MBA, Finance & Strategy

Harvard Business School • 2010

Graduated with High Distinction (Baker Scholar). Focused on Private Equity finance and Entrepreneurial Management. President of the Venture Capital Club.

CFA Charterholder

CFA Institute • 2012

Demonstrated mastery of investment analysis and portfolio management skills. Adheres to a strict code of ethics and professional conduct.

B.S. Computer Science

Stanford University • 2006

Foundation in algorithms and systems architecture. This technical background allows for deep due diligence of software and deep-tech startups.

Certified ESG Analyst

EFFAS • 2020

Expertise in integrating Environmental, Social, and Governance factors into investment decision-making processes.

Experience at leading financial institutions and successful venture firms.

Managing Partner

Horizon Ventures

Leading the Series A & B investment committee. Oversaw the deployment of Fund IV ($250M). Led investments in 12 unicorns including Stripe, Plaid, and Rivian.

Vice President, Investment Banking

Goldman Sachs

TMT Group. Advised on M&A transactions totaling over $15B. Specialized in cross-border tech acquisitions and IPO readiness for late-stage private companies.

Senior Analyst

Bridgewater Associates

Conducted macroeconomic research and developed systematic trading signals for the Pure Alpha fund. Gained deep understanding of global market dynamics.